What does this financing do to my ownership?

It’s fundraising season (it’s always fundraising season), and I’m finding myself helping my awesome entrepreneur friends navigate the exciting “what does this do to my cap table” simulation process.

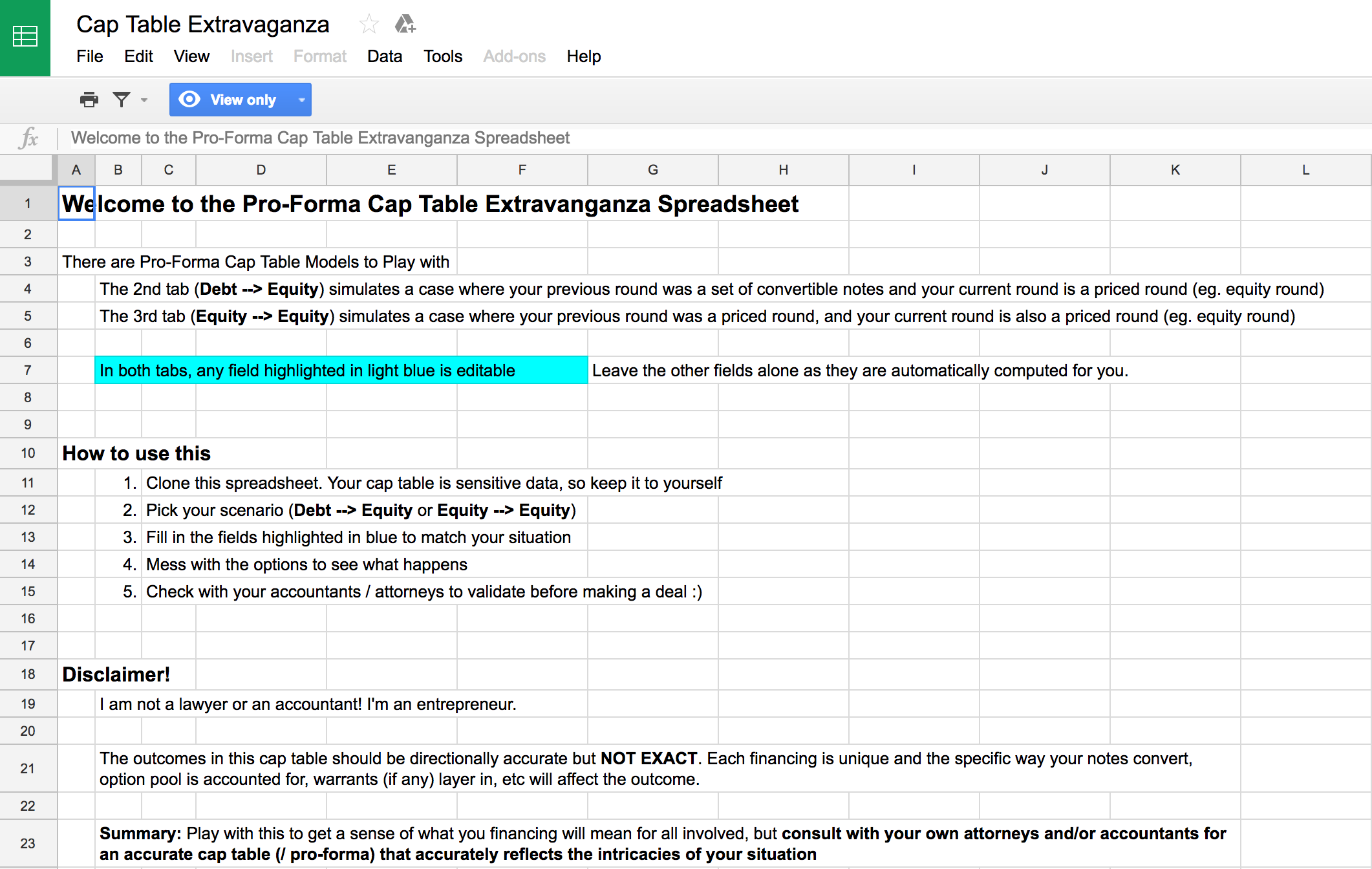

There are some great pro-forma cap table simulators on the web (props particularly to VentureHacks, the godfather of cap table simulators).

That said, I’ve run into a few questions that the existing cap table simulators culled from the wisdom of the internet couldn’t easily answer:

- What happens if I have a post-money option pool target but still have some Unallocated Options?

- What happens if a new investor has an ownership target but my earlier investors want to take their pro-rata too?

- Will the noteholders convert by discount or cap?

- What happens if there are multiple notes in my seed round, with different terms (different discounts, caps, mix of both, etc…)?

- How do I manage total (eg. real) dilution for founders & employees?

So I built my own. It’s here, in case you’re asking yourself the same questions.

Use at your own risk, and — as always — check with your accountants and attorneys before signing anything. The data should be directionally accurate enough to help you evaluate some options though.

Use at your own risk, and — as always — check with your accountants and attorneys before signing anything. The data should be directionally accurate enough to help you evaluate some options though.

If you like it (or want to point out some math mistakes), follow me (@yanda) on twitter.